Dear Coffee Lovers,

what is brewing globally in the coffee industry ?

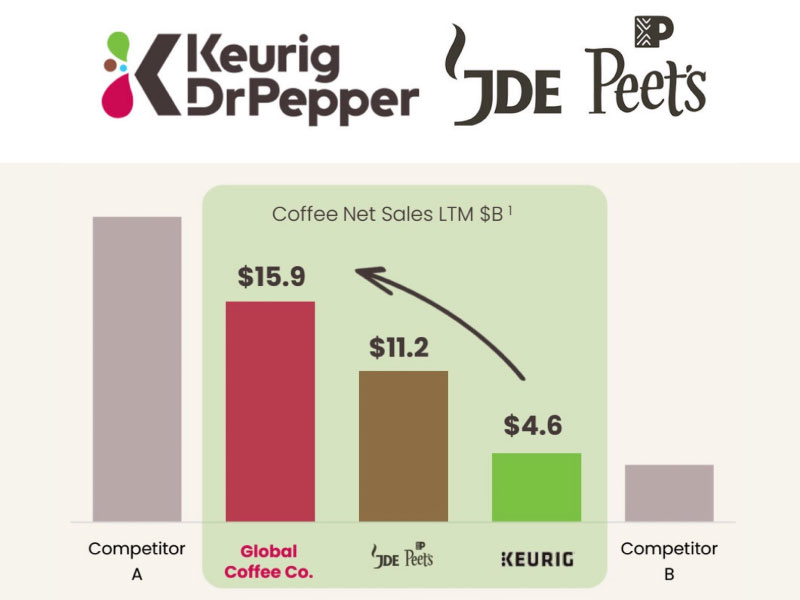

The announced merger of Keurig Dr Pepper and JDE Peet’s has shaken up the global coffee landscape overnight. With combined coffee revenues of roughly $16 billion, the new entity now stands as a clear number two behind Nestlé, closing the gap in scale, portfolio, and geographic reach. Investors initially reacted with caution, sending KDP’s shares down by 10-12%, mainly due to concerns around leverage and execution risk. On the other side, JDE Peet’s shareholders welcomed the 20-33% premium, with the stock rallying nearly 18% on day one.

From a strategic perspective, the logic is compelling: Keurig’s single-serve dominance in North America perfectly complements JDE’s broad retail, out-of-home, and capsule businesses in Europe, LatAm, and Asia-Pacific. The portfolio breadth - from Jacobs and Douwe Egberts to Peet’s, L’OR, Senseo, and Tassimo - is now unmatched, except by Nestlé. This breadth gives the new Global Coffee Co. a strong ability to compete across all price tiers and occasions. At the same time, procurement, logistics, and manufacturing synergies are expected to deliver $400 million in cost benefits within three years.

The risks, however, should not be underestimated. The deal pushes KDP’s leverage to around 5x EBITDA, leading S&P and Moody’s to place ratings under review. Management must now prove it can deliver fast deleveraging milestones while maintaining growth investments. Another key challenge lies in system strategy: will the company focus on Keurig and L’OR as global scalable platforms, or continue spreading resources across multiple capsule systems such as Senseo and Tassimo? Failure to prioritize could weaken the global push.

Nestlé, meanwhile, is unlikely to sit still. With Nespresso Club, Vertuo expansion, and the Starbucks alliance, the Swiss giant retains formidable moats in capsules and branding. At the same time, sustainability pressures around pods and packaging are growing louder, and any misstep here could expose the new Global Coffee Co. to criticism. In Europe especially, private label and discounter brands remain a structural threat.

Still, the long-term opportunity is significant. If executed well, this merger could finally create a coffee champion with the scale, reach, and focus to challenge Nestlé in more than just regional markets. Clarity in system choices, visible synergy capture, and disciplined debt reduction will be the three measures investors watch most closely in the next 24 months.

This merger has the potential to reshape global coffee competition for the next decade - but only if the new Global Coffee Co. delivers clarity, speed, and discipline.

And reflecting on the wider industry impact: For coffee professionals worldwide, consolidation means fewer but bigger players. The challenge is to balance scale with innovation, and efficiency with authenticity.